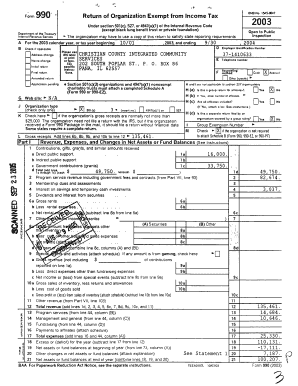

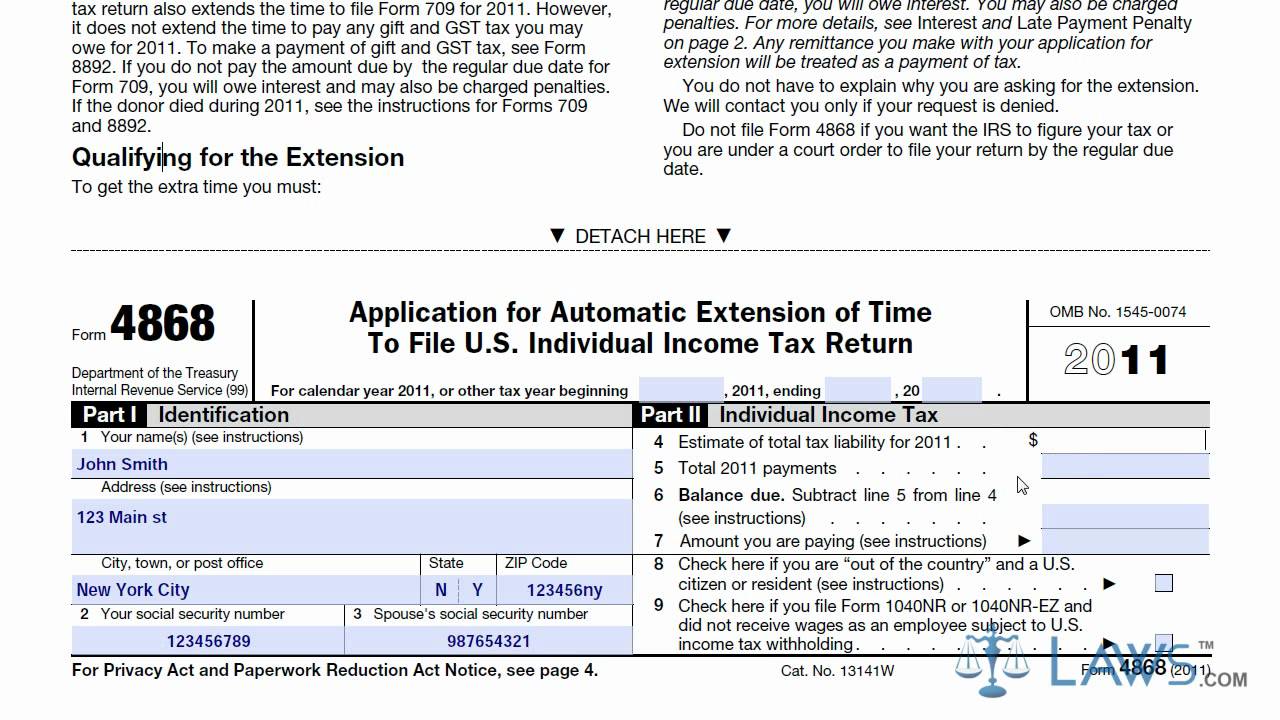

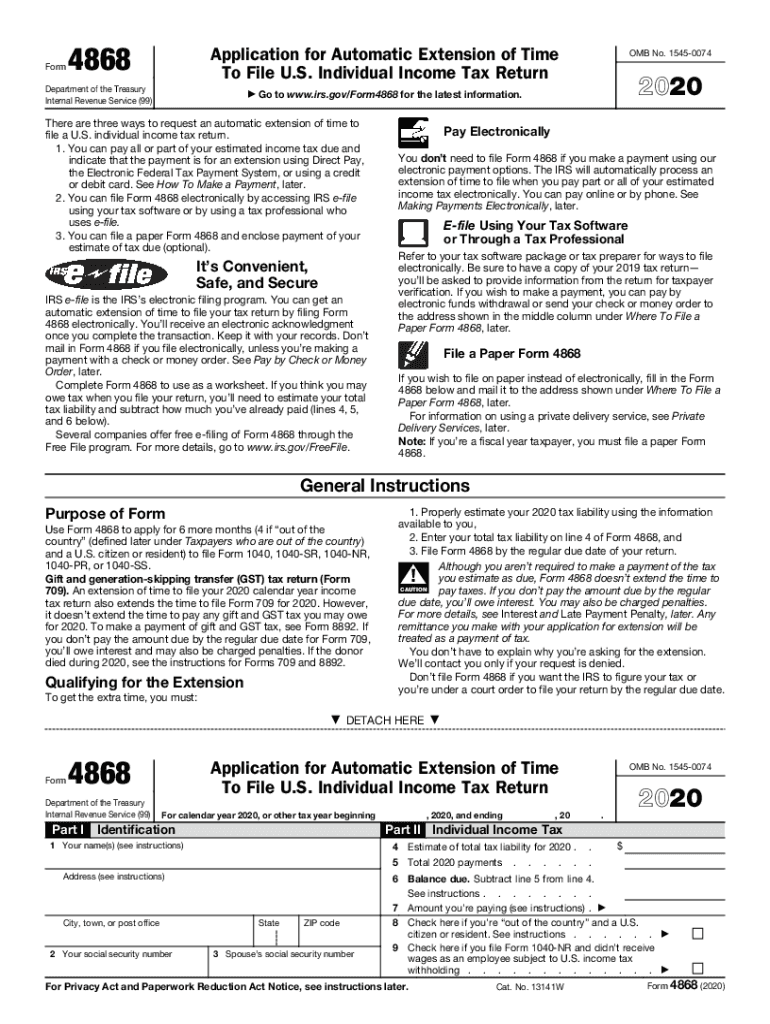

Because a superseding return is treated as the taxpayer’s “first return,” it can be utilized to make or change binding elections that would otherwise not be open to revision. The benefits of filing a superseding return go far beyond the ability to correct errors without risk of an accuracy-related tax penalty. Therefore, a taxpayer who files a valid extension but ultimately files the return sometime before the expiration of the extended filing date will have until that extended due date to file a superseding return. Since the taxpayer was under no obligation to file his return prior to the due date, the IRS is not disadvantaged in any way.įor the purposes of a superseding return, the due date includes any valid extension. By filing a correct superseding return before the due date, the taxpayer has complied with the law and has provided the IRS with the information it needs by the due date. Despite seeming too good to be true, there are logical reasons for this result. This is so even if the taxpayer does not have reasonable cause for the omission, as the superseding return effectively removes the omission from the record. Thus, if the original return underreported the taxpayer’s tax liability, the superseding return can correct that underreporting while avoiding the accuracy-related penalty normally imposed. The superseding return will be treated as the taxpayer’s original return for all purposes. Thus, a taxpayer whose return is due on April 17, 2017, but who decides to file on February 10, 2017, can file a superseding return anytime between February 10 and April 17, making any necessary adjustments. The ability to file a superseding tax return is limited, but where available it is often the best way to correct a previously filed return.Ī taxpayer can file a superseding tax return at any time after filing an original return and before the due date for filing such a return has passed. Thus, in the example above, a superseding return would establish a single $25,000 tax due entry on the taxpayer’s account.

When a superseding tax return is filed, it is as if the original return were never filed.

In certain situations, a taxpayer can effectively undo the filing of the original return and file a revised, or superseding, return.

0 kommentar(er)

0 kommentar(er)